MS Pro Briefing | 5th November 2025

Small-cap premium, sin portfolio, buybacks, and more..

MS Pro has a simple aim: to make your job easier. Our team combs through hundreds of academic and institutional reports every week. With MS Pro, we seek to simplify this into clear, concise, and actionable insights.

Actionable Insights

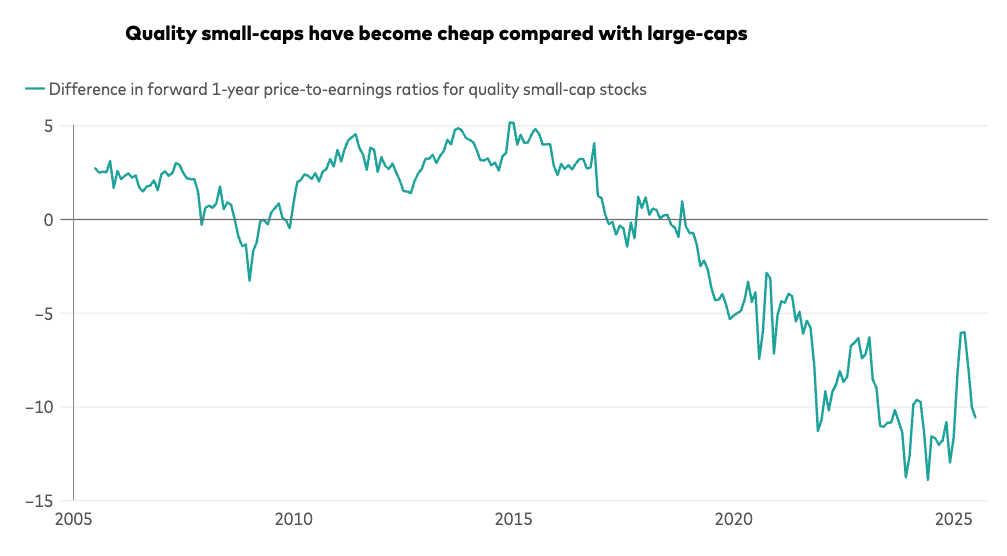

Quality small-cap stocks are now trading at a significant discount to comparable large-caps.

History indicates that timing the market based on yield curve signals is exceedingly difficult.

A sin-weighted portfolio generated an annualized Fama-French 6-factor alpha of 4%.

Buybacks signal confidence and attract capital to undervalued firms, thereby increasing long-run shareholder value rather than destroying it.

The lost decade for small-cap stocks

U.S. small-capitalization stocks have now underperformed large-capitalization stocks for a decade, a reversal of the historical small-cap premium. Recent analysis by Vanguard suggests several structural factors behind this shift.

Smaller companies, as a group, have seen deteriorating quality: as of mid-2025, almost one-third of Russell 2000 companies were reporting losses, whereas large caps maintain far higher profitability.

Sector composition has also played a role: large-cap indices are far more tech-heavy (37% of the Russell 1000) than small-cap indices (only 12% tech).

The silver lining is that small-cap valuations have fallen to very attractive levels. By mid-2025, quality small-cap stocks (profitable ones) were trading at a significant discount to comparable large-caps.

Vanguard’s capital markets team now projects that U.S. small-caps will outperform large-caps by ~1.9% per year over the next decade.

Active managers are already leveraging this mispricing: 18% of active small-cap blend funds beat their benchmarks over the past 10 years, vs. only ~6% of large-cap blend funds.

Source: Fading small-cap premium and softer U.S. labor market (Vanguard)